Join us at:

Photos provided by: Rafael Garcin on Unsplash.

Join us at:

Photographs provided by: Rafael Garcin on Unsplash.

Join us at:

Photographs provided by: Rafael Garcin on Unsplash.

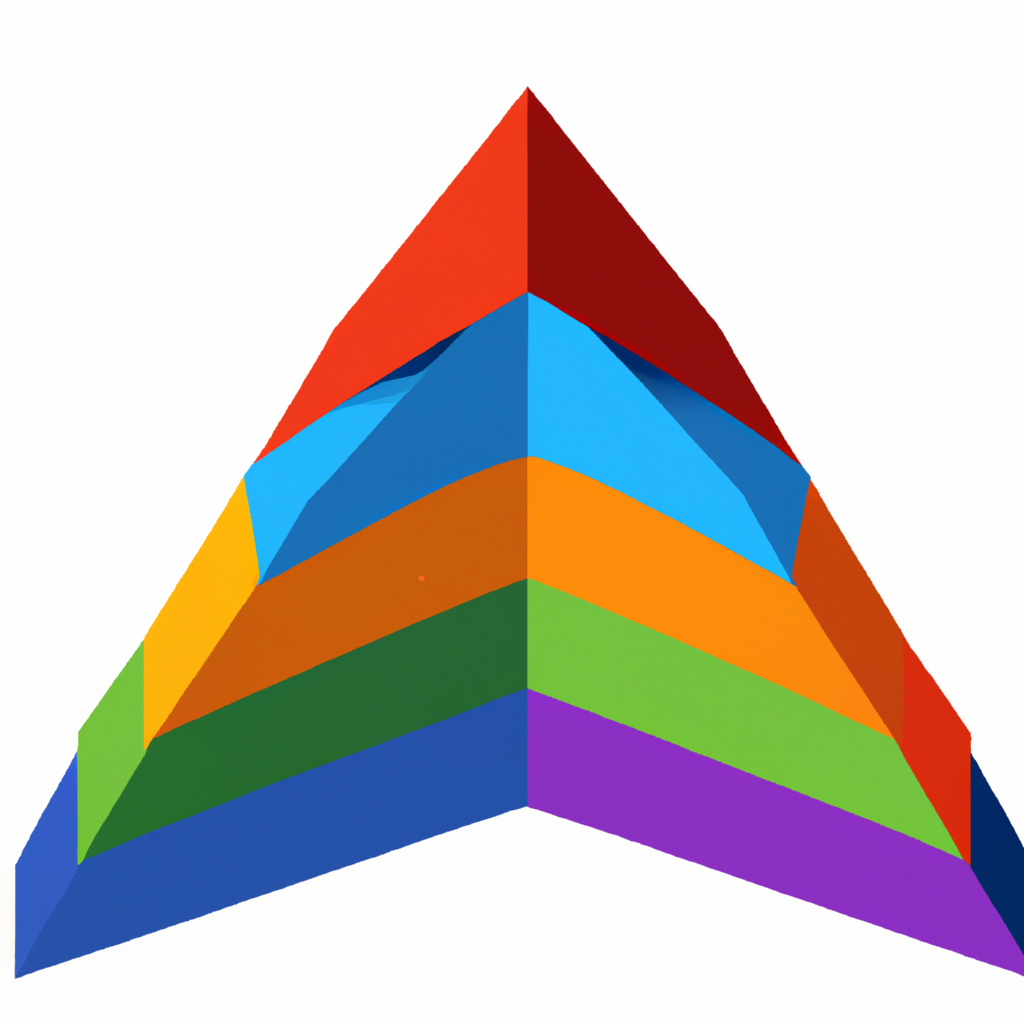

The hierarchy of requirements in revenue management

Content

In 1943, psychologist Abraham Maslow proposed a model that organized human needs into a hierarchy, ranking them according to their relevance. This recognized and effective model applies very well to the business world, especially in the hospitality industry. We can adapt this idea by placing the most essential needs at the base and, as they are satisfied, we can move on to the next ones. However, whether due to lack of time or work routines, we sometimes overlook the most basic needs of our business.

After the publication of my previous article entitled "The Revenue Management Iceberg", in which I compared the numerous tasks to the depth of an iceberg, I received a lot of comments and questions. The most frequent query revolved around how to determine priorities among so many activities. So, taking Maslow's pyramid of needs as a reference, I have decided to summarize in five levels the fundamental pillars that I consider essential, which I will go on to detail.

The essence: Pillar of distribution, who are our customers, what products do we offer and for what purpose?

I would like to stress the importance of this often overlooked starting point that organizes our sales strategy. In my view, it is a mistake to focus on inventory or yield management tactics without having this solid foundation in place. Ignoring this fundamental need is like trying to build a house starting with the roof. I am referring to the control that will influence the future profitability of the business. It is a sensitive aspect, as it confronts a prevalent business mentality, where the main focus should not be to simply sell and sign contracts under the false belief that the more contracts we sign, the more we will sell. At this point, we must be convinced that a mess of contracts can threaten our pricing strategy, our direct sales channels and, consequently, the profitability of the business.

In 2007, I participated in a study evaluating the possibility of discontinuing work with a particular bed bank. The discussion was intense. From the commercial area, it was seen as a big risk and they were firmly against it, due to the considerable production generated by this bank (which should be a warning sign). They were not willing to do without such a significant client. On the other hand, the Revenue team showed, after reviewing each booking, that much of that production was cannibalizing other segments that offered higher prices, including corporate rates in urban hotels and other channels. Most worryingly, this situation was detrimental to our direct channel strategy, diminishing its potential and losing control over distribution. Finally, it was decided not to renew it, which generated unprecedented commercial pressure, as we had to justify each month the decrease in production of that account with the increase in other more profitable segments.

After its first year, the hotel managed to significantly increase its RevPAR and experienced a double-digit increase in ADR, far exceeding the average at the time. Moreover, this increase in ADR translated directly into an improvement in GOP. This strategy was then applied to the entire company, which had more than 1,100 hotels worldwide. This experience shows us that sometimes, out of fear or by following traditional methods, we fail to take complete control of the business. Therefore, I believe that the fundamental key in Revenue Management is to have an effective control of distribution to ensure an orderly sales process. We can then identify opportunities in a clear environment to optimize financial results, but it is essential to have a solid foundation. In fact, most of the optimization opportunities arise from proper distribution, while only a small part comes from inventory control.

Strategic need: direct channel, pace, positioning and performance

Once we have organized sales, we move on to the next need in our hierarchy: the one that helps us structure the pricing strategy and mitigate the risk of cannibalization. Now, with greater freedom and control, we establish our pricing policy, prioritizing first the direct channel, market positioning, digital marketing actions, group strategy, among others. When distribution is well organized, the pricing strategy acquires its true meaning. We stand at the essential core, ready for critical evaluation, where we monitor the pace and evolution of performance to validate our strategies. We analyze the optimal mix per segment, taking into account this orderly distribution and the actual market position, i.e. what demand indicates. It is crucial that our strategy is clear and precise, with a gradual approach to performance to avoid abrupt last-minute changes due to lack of sales, which often leads to losses. We reject hasty decisions that ignore information, which helps reduce risk by not taking a holistic approach to the business. For all these reasons, I always examine opportunities carefully, as they require deeper analysis and understanding, and after being evaluated, they do not always turn out to be viable opportunities. This practice, which should be simple, is not always so in reality.

In my experience, it is critical to implement a clear and simple strategy, backed by a robust structure. This simplicity tends to be more effective than a lot of complicated micro-strategies that often contradict each other as time progresses. There is a mistaken belief that by introducing more exceptions to the overall strategy, we are achieving better results. Although in our daily routine we make many adjustments, these must be consistent, avoiding unusual combinations that can distort the approach and leave us disoriented among so many exceptions.

Unfortunately, this second need is often the starting point for the actions of hotel revenue departments, which have no control over the fundamental need for distribution. This happens because, generally, management is external to the hotel chain. Although it is necessary to have a general distribution strategy, it is important to recognize that what works for an urban hotel is not applicable to a vacation resort. Even among different hotels there can be variations, so global agreements can adversely affect the specific interests of each establishment. It is essential to move towards a distribution adapted to the particular needs of each hotel, always seeking to improve results. Our goal is to move away from simple inventory management to a more proactive approach that allows complete control of the business.

Total Income Requirement: Food and Beverage, spa, additional income...

We move on to the next need. At this point, having secured a proper distribution and a coherent strategy, it is time to diversify the hotel's revenue sources. We must adopt a broad perspective, with a global "Creative Thinking" approach. In other words, we seek to improve total revenue per occupied room in innovative ways. It is crucial to create a portfolio of experiences that transcends just lodging revenue, integrating dining and wellness options, and increasing the variety of offerings. We finish with a defined upselling and cross-selling strategy, paying special attention to additional revenues. Everything in the hotel has the potential to generate extra revenue. Therefore, it is essential to implement specific strategies for each source of revenue, with the objective of maximizing profits at every stage, from booking to arrival and during the stay.

From an initial unestablished demand, we develop and improve RevPAR, increasing GOPPAR through a comprehensive Total Revenue strategy, which will allow us to optimize financial results. Although it is a rhetorical question, there is no specific percentage of optimization that serves to compare room revenue with other revenues of a hotel, as this varies according to the services that each establishment offers. Generally, profitability is much higher in lodging management than in food and beverage, where excellent management is required to maintain an adequate P&L. In addition, it is possible that in periods of low demand, the GOP may be affected if the structure and cost management are not adequate, due to high fixed costs and the constant increase in food cost.

Importance of evaluating results and KPIs

It's time to analyze and compare the hotel's performance. I always focus on the most relevant KPIs, as there are a lot of them. In fact, some people in Revenue Management create new indicators, but the key thing is to focus on the ones that really matter. Our goal is to monitor how we are meeting our goals after implementing the strategies and to compare ourselves with the market and our competitors.

The question is always the same: have we done a good job? We may have achieved our goals or, on the contrary, we may not have achieved them, but that does not imply that we have not managed the hotel efficiently. Let me clarify: if we did not achieve our targets and yet our RPI (Revenue Performance Index) or RGI (Revenue Generation Index) is higher than our benchmark group, it means that we have maximized the hotel's performance in a more effective way, suggesting that the targets were too optimistic considering the actual demand. On the other hand, if we have exceeded targets and are satisfied, but the increase in RPI or RGI is lower than the competitive group, we may have missed revenue opportunities, despite meeting targets, reflecting a conservative approach. As we always comment in the Revenue area, projections are only valid at the time they are made, as market and competitive conditions are constantly changing, and we cannot foresee long-term changes in demand and competition.

Among the most relevant KPIs I highlight RevPAR, which focuses on channel optimization and the relationship between occupancy and ADR, as well as TRevPAR, which includes additional revenues. Also important are RPI or RGI, which measure RevPAR penetration compared to the competitive group, where we look at MPI (Market Penetration Index) and ARI (Average Rate Index), analyzing our performance compared to the previous year and the competitor group. It is interesting to consider TRevPOR, which measures total optimization per occupied room, and it is useful to break down how much comes from ADR and how much from other revenue strategies, such as food and beverage or spa services. Finally, it is crucial to consider KPIs that are affected by cross-channel sales and business management strategy, such as GOP (Gross Operating Profit) and GOPPAR (per available room). These indicators are part of the USALI (Standard System of Hotel Accounting) fundamentals, and at lower levels is EBITDA, which is the main focus for owners. Although there are numerous specific KPIs for food and beverage or spa, as I have mentioned in previous articles, these are the most essential for evaluating hotel performance, avoiding distractions from more complex indicators that we only review occasionally.

The pinnacle: The need for control

At the top of the pyramid, the optimization cycle is completed, and the different strategies implemented are adjusted to maximize the most essential, which is the GOP. We must question ourselves: How has demand responded to price changes? What is the cost per channel and the impact of distribution? Which digital marketing campaigns have performed better? Have we managed to increase the RGI or the change in RPI more than our competitors? Are customers arriving by occupancy or ADR? What aspects can we improve?

So far, we have not mentioned ADR, as it should never be our primary goal. In general, increasing ADR excessively usually has a negative effect on the hotel's GOP. ADR should be seen as the consequence of doing our job well, making the most of the opportunities in the different channels, optimizing direct sales and managing both distribution (the costs associated with each channel) and inventory. This will allow us to achieve the highest possible ADR. As I always repeat, the real owner of the ADR is the demand!

By focusing on the essentials, it is clear that achieving optimal market balance on an ongoing basis is the most challenging in our daily work. As Abraham Maslow mentioned, "The best way to approach a problem is to fully engage it, investigate its essence and find the solution within the problem itself." This tells us that in order to face challenges, we must first understand them.

Photographs provided by: Rafael Garcin on Unsplash.

Rafael Gómez holds the position of Director of Revenue Management at Minor Hotels and is the creator of Revenueresort.com.

related items

Proactive hospitality: more focus on intelligence rather than superficial AI...

The 7 major trends that will influence tourism in 2026

Spain is positioned as one of the most chosen destinations by travelers...

Company Guide

LATEST NEWS

Proactive hospitality: more focus on intelligence rather than superficial AI...

The 7 major trends that will influence tourism in 2026

Spain is positioned as one of the most chosen destinations by travelers...

NEWSLETTER

Would you like to be the first to know the latest news? Subscribe to the TecnoHotel newsletter.

FOLLOW YOU

TecnoHotel stands out as the only Spanish-language magazine dedicated to examining and transmitting the most relevant trends that, due to their continuous change and development, are of great interest to leaders in the tourism sector in the 21st century.

TRENDS

Digitization of Human Resources in the hospitality industry: the role of HR ....

Leadership and talent as drivers of genuine innovation: "It is essential...

Spain is positioned as one of the main destinations chosen by travelers...

NEWS

Agent-based hospitality: less superficial AI and more intelligence than...

The 7 megatrends that will define tourism in 2026

Spain, a favorite among tourist destinations...

NEWSLETTER

Would you like to be the first to know the latest news? Subscribe to the TecnoHotel newsletter.

STAY IN TOUCH

TecnoHotel is the only Spanish-language magazine dedicated to examining and disseminating the latest developments in the hotel and tourism industry, which, due to their continuous transformation and evolution, are most relevant to tourism industry leaders in the 21st century.

We use cookies to improve your experience on our site. By using our site, you agree to our use of cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

You can find more information in our Cookie Policy and Privacy Policy.